For All Your Property Surveying & Valuations in South East London, Kent & Surrey

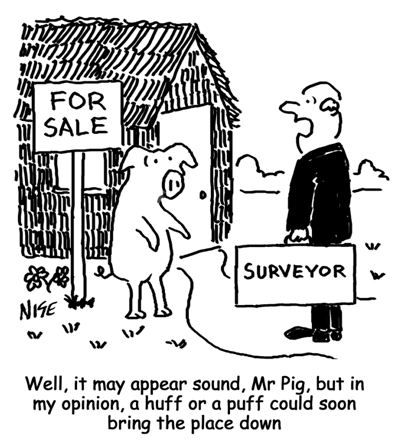

We know that when buying a property money can be tight and it is tempting to rely solely on the mortgage valuation report, mistakenly believing that it is a survey of the property.

A mortgage valuation report is based upon a relatively cursory inspection of the property and is commissioned by a mortgage lender (even though in most instances the buyer has to pay for it), merely to establish whether the property represents adequate security for the mortgage loan.

As the Council of Mortgage Lenders advises, there may be many deficiencies/defects to a property that are of no consequence to the mortgage lender, but they could be very much of consequence to a prospective purchaser.

Therefore, relying solely on the mortgage valuation is a false economy. Any prospective buyers who commission their own private survey report may be able to re-negotiate the purchase price by thousands of pounds once they have received their survey report, because defects/deficiencies to the property which would not necessarily have been included in a mortgage valuation report will be reported in a private survey report.

We strongly advise that buyers commission either an RICS Home Survey or a full Building Survey and in this way the full facts of any defects are known prior to purchasing a property.

We are happy to offer a FREE consultation, Call us on

020 8650 5799 | 020 8658 4010

020 8650 5799 | 020 8658 4010Bernard Pett Surveying has expertise and experience as Chartered Surveyors, Registered valuers and Development consultants.

Beresfords Ltd 2025 | All Rights Reserved | Privacy Policy | Built by